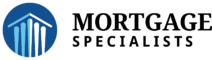

One common question we hear is whether you can be considered a first-time homebuyer, even if you previously owned a home with your former spouse. For many Nebraskans, the answer might be yes, opening doors to valuable assistance programs.

Best of Omaha Winner since 2021

© Mortgage Specialists.

© Mortgage Specialists.